Check product online

Any check issued by a cash register is a document. This is a kind of special form of strict reporting. It must contain certain information, and its reliability is important not only for the client, but also for the business owner, tax authorities. There are several ways to determine whether a genuine check was received after the purchase of the goods.

- Who checks checks

- Why Check Checks

- What should be on the check

- Appearance of a check

- Verification methods

- Checking a check using a QR code

- Via the FTS website

- With the application of the FTS

- With the help of OFD

- Online check check: step by step instructions

- What fields are required on a receipt?

- 5 handy apps for scanning receipts

- 1. Check Scan

- 2. Spendlist

- 3. FinPix

- 4. My Coins

- 5. Zen money

- Possible test results

- Who is interested in the legality of the fiscal check

- Who may need check authentication

- What to do if there is no check in the database

- False negative result

- Conclusion

Who checks checks

Several categories of citizens can check the authenticity check received after the purchase of the goods. First of all, these are customers and store staff.

Also, the verification can be carried out by the business owner and the fiscal authority.

Why Check Checks

The authenticity of the receipt received after the purchase of the goods gives the buyer a guarantee for the service, proves the very fact of the purchase. Such a document is legally binding. Therefore, checking a cash receipt online allows the buyer to be sure that consumer guarantees are kept behind him.

Also, after verification, a copy of the document in electronic form can be sent to your email inbox. This will allow you to store the check in a safe place and print it at any convenient time if the original is lost.

A copy also has legal force and with its help you can assert your rights.

Broken checks should be checked daily by store employees. It is enough to select one or two documents. The audit will reveal hidden problems of the fiscal apparatus and take timely measures to eliminate them. Otherwise, during the inspection of the tax authority, such a thing is punished with a large fine, more stringent measures are applied. Therefore, every seller should know how to check the check online and do it 1-2 times during the working day.

Regular verification of the check will allow the business owner to determine the authenticity of the document that is issued to customers and take timely action if the check is not entered into the FTS database.

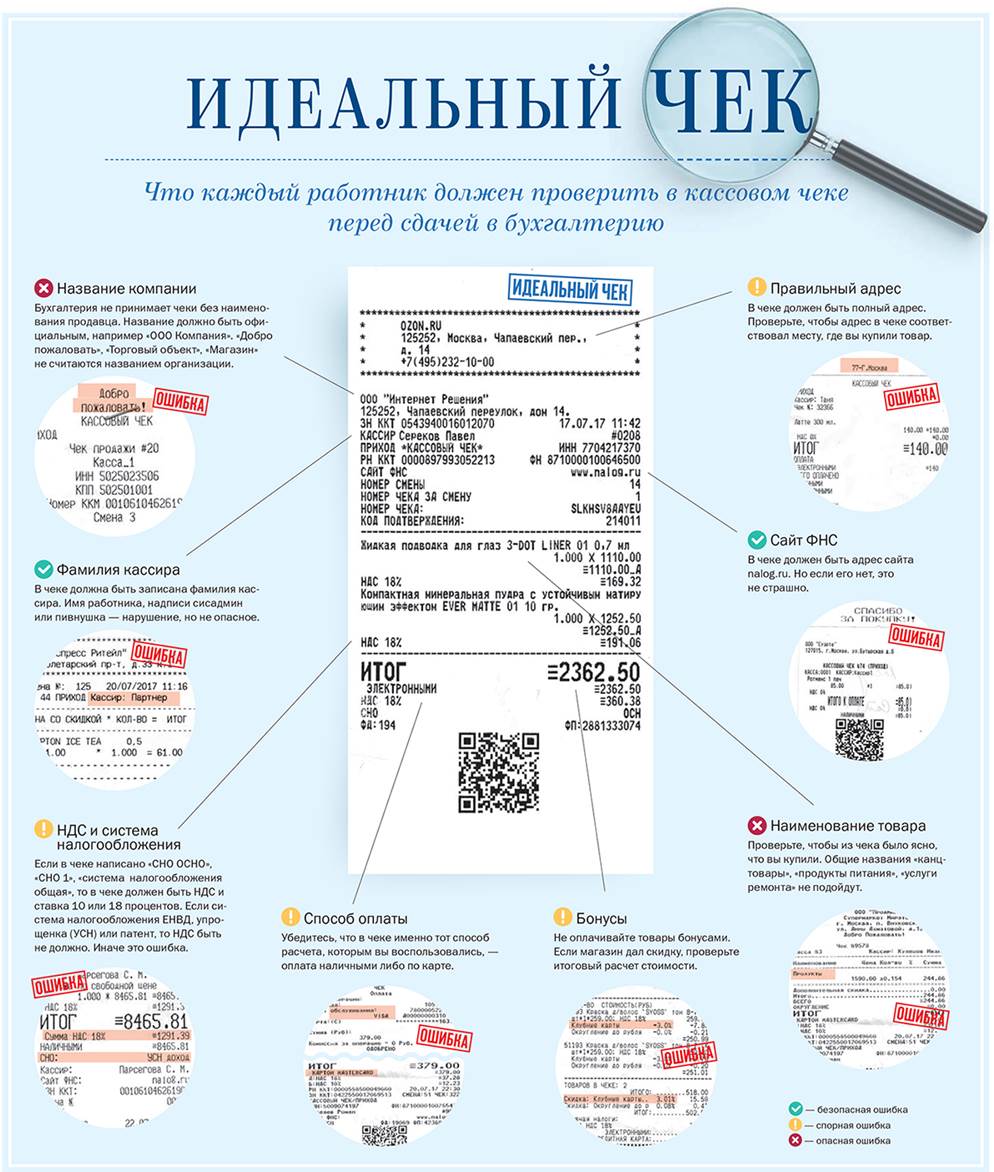

What should be on the check

In accordance with the law, 20 items must be reflected on the checked check. These include the date and time, the address and TIN of the store, the name of the product, the number of the cash register and the name of the organization that serves it. These and other data are mandatory.

But on the check of an enterprise that operates under PSN or UTII, this list is smaller.

But even the absence of one position is punishable by a fine or suspension of business activities for up to 3 months.

The thing is that a check is an important document, and it must be filled out correctly, in accordance with the law.

Thus, the authenticity of any check punched by a cash register indicates that the entrepreneur complies with the established procedures and regularly pays taxes, informing the tax authority about each sale. At the same time, the buyer can be sure that after the purchase of the goods, all the statutory warranty rights are retained.

Appearance of a check

The easiest way to verify that the received check is genuine is to verify the details. Each line should be looked at carefully. The document stamped with a simple checkout terminal must contain the following data:

- The time and date the check was struck.

- The cost of a product purchased or a service received.

- The serial number of the document.

- Individual taxpayer number.

- Registration number of KKT. Issued when registering the terminal, it is also an important parameter.

- The name of the store or business.

Also on the check there should be an indication of which taxation system the seller works under.

On the document issued at the online cash desk, in addition to the data already listed, the following must also be indicated:

- Name of the product or service, quantity.

- Total cost and price per unit.

- Availability of discounts and the cost with its taking into account.

- Payment method. The arrival was carried out in cash or by bank transfer. This is necessary to verify the terminal for payment by plastic cards.

- Place of settlement. It can be the address of a store or a website.

- Fiscal number.

- income or expense.

- Sequence number of the check for the current shift.

- Name of the cashier working behind the machine.

- Shift number.

- Information about VAT, value added tax.

When at least one of the listed items is missing on the check, the operation of the cash register should be immediately suspended.

Such a document has no legal force.

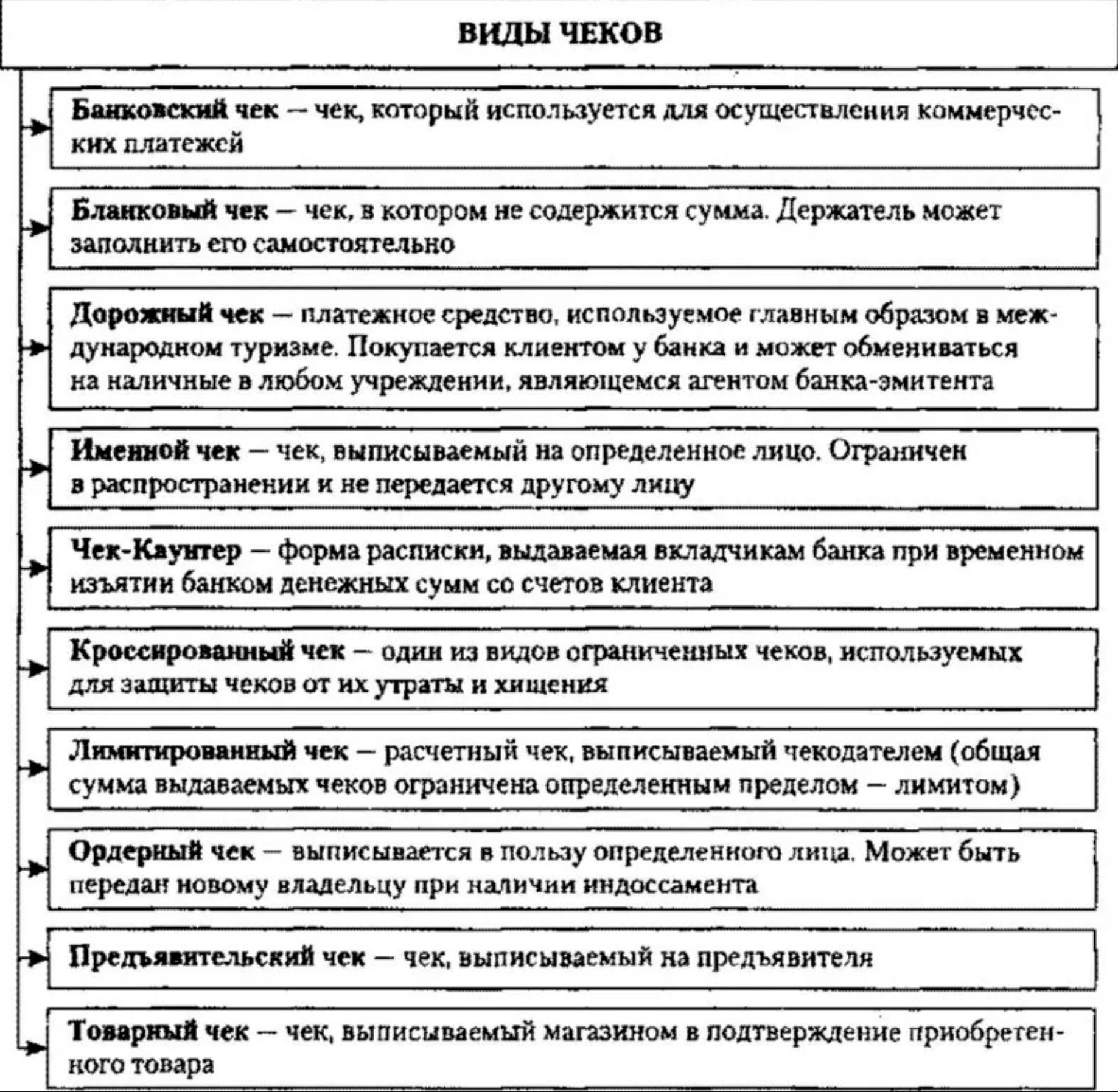

Types of bank checks according to the form of circulation of finance:

| Peculiarities | Cash | Estimated |

| Form of receiving money | Cash | Cashless |

| Purpose of obtaining | Salary, travel allowance, groceries | For goods and services, as a rule, in counterparty settlements |

| Transfer moment | There is a time gap between receiving funds and making targeted spending | Transferred by the payer to the recipient at the time when the operation is performed |

Types of bank checks by type of statement:

| View | Recipient |

| Nominal | certain person |

| bearer | The person who issued the document |

| order | Beneficiary or endorsee to whom the endorser or drawer transfers the check as a new owner through the endorsement procedure |

| Crossed | On the front side, the document is crossed out with two parallel lines. Check can be marked with only one crossing |

| With common crossover | Between the lines is empty, there may be a label "bank". Paid by the paying bank only to another bank or to its own client |

| With special crossover | The name of the payer is entered between the lines. Paid only by the specified bank |

Verification methods

There are several ways to quickly check a receipt online after purchasing a product or providing a service. It will take a little time, a smartphone and the Internet.

Checking a check using a QR code

On any fiscal document there is a special QR codelocated at the bottom. It is on it that you can verify the authenticity of the check number. To do this, you need to download the mobile application of the Federal Tax Service.

Before installing the application, it is important to make sure that the seller of the Federal Tax Service of Russia is indicated. If this is not there, or if there is a name of another country, you should not download the application. As a rule, these are scammers who will try to steal all the information from a smartphone.

If the document is printed according to all the rules and is not a fake, you can send a copy of it for printing or send it to an email address.

If the application indicates that the check is invalid, you must file a complaint with the IRS.

To compare all details on paper and electronic, you need to select the item "my checks".

The application has the ability to create your own QR code. This allows you to instantly read the contacts of the client. It will need to be shown when the buyer comes to the checkout to pay for the goods. Before paying for a product or service. Then the check will come immediately in electronic form. You can find a personal code on the main page in the "business card" section.

The application is quite convenient and easy to use. With it, you can be sure that all warranty opportunities remain with the buyer for the entire period of the warranty.

Via the FTS website

The website of the Federal Tax Service is designed in such a way that everyone can find answers to their questions there without waiting for a long answer. In the same place, you can quickly check the fiscal document for authenticity and make sure that the seller is honest.

To do this, go to the website of the Federal Tax Service, find the section "Check Check". To do this quickly, you need to scroll through the pages to the bottom, where it says "check the check right now." All required fields must be filled in and click "verify".

On the website of the Federal Tax Service, you can check the registration number of the cash register and fiscal drive in the register. Their presence in the list will indicate the integrity of the seller.

With the application of the FTS

In order to check the cash receipt, you can use the special application of the Federal Tax Service. It is designed for gadgets on the Android and iOS platforms. It is not possible to check the document on the tax portal, since this function is not provided there. But you can check a special chip on fur products.

First of all, you should download the application. After installation, the first time you use it, it will require you to enter your data. Anonymous verification is not provided. You will need to verify your phone number.

To carry out the check, you must fill in all the required fields or scan the check, which are indicated in the application from the check on paper. The test result is displayed immediately after a short processing.

If the authenticity is confirmed, a copy of it in electronic form can be sent to your email inbox. In the event that the document does not meet the standards and requirements, you can immediately send a complaint to the Federal Tax Service.

Also in the application it is possible to scan the QR code of the receipt for a quick check. The application from the Federal Tax Service is the best, as it has additional features that are not available on other portals and services.

With the help of OFD

You can check the authenticity of the check using the OFD. Through it, the seller transmits the testimony from the fiscal apparatus to the Tax Service. To do this, you will need to go to the OFD verification site, which should be indicated on the fiscal document. The service will require you to enter some data. All of them are indicated on the document. The authenticity of the check indicates that the entrepreneur conscientiously fulfills his obligations to the Federal Tax Service and regularly pays all taxes, legally conducts his activities.

Online check check: step by step instructions

One of the ways to check the authenticity of a check is a special application developed for the Federal Tax Service. It's very easy to do this:

- Go to the official website of the FTS. There you need to find a link to download the official application "checking a cash receipt". You can see it in the section “new procedure for applying CCP”. It is important that the Federal Tax Service of Russia is indicated when downloading. Otherwise, these are scammers who quickly download the necessary information from a smartphone and use it for criminal purposes.

- Download application. It's free, fast and secure for any device.

- After the verification service, authorization is required at the first login. You need to enter personal data such as last name and phone number. You only need to enter your real name and other information, as you will need to confirm the phone number. It is better not to take risks by entering deliberately false data.

- Enter the readings of the fiscal document requested by the application. For convenience, a QR code is provided. It is located at the bottom of the check.

- To get the result, you need to click "send request".

- You will not have to wait long for a response from the Federal Tax Service after completing the scan or entering the data. Information is processed at a high speed, and it takes only a few seconds.

- If the document is genuine, a copy can be sent to an email address or printed. In this case, the copy will also have legal force as the original.

In the case when the application did not find the check number and data about it, you need to check the correctness of the entered details during manual entry. But if everything is correct, then the document is a fake and has no legal force. It is framed incorrectly. Then you need to send a complaint to the Federal Tax Service, after which this seller will be checked.

Checking the cash receipt online after the purchase allows customers to be sure that they retain all warranty rights after the purchase of a particular product. This is very important, especially when spending heavily.

What fields are required on a receipt?

In the fiscal document, according to Federal Law 54, the following details should be reflected:

- income or expense. The sign of the calculation must be specified.

- Date and time of settlement, place of settlement, transaction number.

- Fiscal apparatus number assigned at the factory.

- The taxation system under which the business owner works.

- The name of the goods or services that the visitor received.

- The address of the OFD website where the system sends online checks.

- fiscal sign.

- QR code.

- Registration and serial numbers of the terminal assigned during its registration.

- Shift number.

- Barcode.

- Form of calculation. How exactly was the payment made: by bank transfer or cash.

- Fiscal sign of the message.

- The amount in full with a separate line indicating the size and VAT rate.

Each parameter must be indicated on the document. The absence of even one of them leads to a fine for the business owner, since the electronic check will be invalid. In some cases, the Federal Tax Service may suspend the activities of the enterprise for up to 90 days to check the documents and activities of the organization.

5 handy apps for scanning receipts

Useful tools for those who are used to recording all their expenses.

1. Check Scan

This is one of the most practical and user-friendly applications for scanning cash receipts with QR codes. It allows you to get information on all purchased goods by finding out the prices for them in other nearby stores.

Also, "Check Scan" allows you to create shopping lists, the goods in which will be automatically supplemented with prices from outlets. This will help calculate their total cost before going to the store. In addition, it is easy to share your lists via instant messengers, SMS and social networks.

2. Spendlist

This is a simpler analogue of the first application. It does not have a price comparison function, but there is an automatic deletion of products from the list of planned purchases. This happens as soon as the desired item is seen in the new check.

There is a function to send an online cash receipt with a QR code and a link to Spendlist. The shopping list in text format can also be shared using any convenient application.

3. FinPix

This is a full-fledged financial assistant that has in its arsenal a unique function of scanning not a QR code, but a text. It is enough to take a photo of the check, and FinPix will automatically recognize the name of the goods, their quantity, cost, discounts and the total amount of purchases.

Sometimes the application makes mistakes, but you can always manually edit the check markup. It is also possible to specify which categories individual products belong to. This will automatically allocate all positions from the check to the available sections for maintaining expense statistics.

4. My Coins

A convenient financial manager that will help you meet your pre-planned budget. The application recognizes the goods in the receipt by the code and allows you to allocate them to different categories of expenses. You can change the total if necessary.

For systematic payments and receipts, special rules are available that allow you to automatically make changes to the budget on certain days. Such edits are accompanied by notifications so that no operation is left without attention.

5. Zen money

This is one of the most functional personal finance management tools that can also save expense items by scanning QR codes. The category can be selected both for the total amount in the receipt and for each recognized product.

"Zen-Money" automatically takes into account transactions from SMS from banks and generates visual statistics on all actions. There is a debt tracking function, as well as the ability to create a family budget for several users.

Possible test results

Regardless of which method of verifying the authenticity of a fiscal receipt was used, there can be only two results:

- positive;

- negative.

In the first case, the electronic check is genuine, the owner honestly pays all taxes, and the buyer can be sure that all warranty opportunities are retained.

A negative result, when an online check is not found in the database of the Federal Tax Service, does not in all cases indicate that the document is a fake. Reasons for a negative result may include:

- OFD website error. The operator does not have receipt data that is not issued by its customers. A guaranteed correct result can only be obtained when checking the document online on the tax website or in the application of the Federal Tax Service.

- Faulty cash register or lack of Internet connection. This is possible with couriers and sellers working on the road. Data during the working day is accumulated in the fiscal terminal and is not transmitted.

- Checkout and printer malfunction. In this case, the electronic check will not be fully printed.

- Error when manually entering details. The ink used for checks tends to fade, as a result of which many numbers become difficult to distinguish.

If the CCP is faulty or there is no Internet, all readings after repair or connection are automatically sent to the tax inspection authority.

But in the case when it is not possible to repair the fiscal apparatus, then the business owner must independently provide the data after they are withdrawn to the tax office. But as a result of a breakdown of the CCP, the check will not appear in the FTS database for several months. This does not mean that the document issued by the terminal is fake.

Who is interested in the legality of the fiscal check

Several people are interested in the fact that the document is genuine. First of all, it is the buyer or recipient of the service. The receipt is a guarantee that all warranty conditions are valid.

Also, cashier employees and the owner of a store or enterprise are interested in the authenticity of the check. The absence of even one prop leads to a fine or a temporary suspension of activities.

Fiscal authorities supervising the circulation of such documents are also required to verify the authenticity of the check number. This indicates that the entrepreneur conducts legal activities and regularly pays taxes.

Who may need check authentication

The authenticity of a fiscal document is important to all participants in trade relations. First of all to clients. An electronic check indicates the legality of the transaction, the presence of a guarantee for the purchased goods.

The business owner and checkout staff should also check the authenticity of the check regularly. This will allow you to identify the malfunction of the equipment in a timely manner and take timely measures for repair.

Regular audit is also important for the tax authorities. Online checks allow you to track the movement of the entrepreneur's finances, to exercise supervision over taxpayers.

What to do if there is no check in the database

If the result is negative when verifying the authenticity of a fiscal document by number or code, you can reconcile a little later. Perhaps the documents did not have time to be loaded and processed by the system. Most likely, this is due to the fact that the device is not working properly.

But if a re-check after some time also gave a negative result, you should send a complaint to the tax authority.

False negative result

The use of modern technology does not exclude the possibility of obtaining a false negative result. The check may not be found for several reasons:

- Breakdown of the checkout terminal.

- No internet during checkout. The data is accumulated on the fiscal apparatus. As soon as a connection to the server appears, all data is quickly updated.

- Checkout printer failure.

- Incorrect details were entered in case of manual entry.

- The request was sent to the wrong OFD.

It is recommended to re-check after 2-3 months. In the case when it also showed a negative result, it is better to send a complaint to the tax authority to carry out an audit of the activities of this enterprise.

Conclusion

Fiscal check is a document of strict accountability. It indicates the data of the enterprise, according to which you can establish the legality of its activities and be sure of the safety of your warranty rights. Checking the CCP allows you to determine the authenticity of the check, keep a copy of it, and, if necessary, send a complaint to the Federal Tax Service. Any activity from which the entrepreneur receives money must be legal.

Great topic. I've never done this before, but now I definitely will. Usually I always threw away the check, and often I never took it, but now I understand that there is a lot of interesting and useful information for me. Respect to the author.

Perhaps even children know about the need to save a check! And the main thing is not so much to check the legality of the business - it is mandatory when registering the return of goods to the seller or you will have to look for witnesses to the purchase! Personally encountered: I bought a modem with a SIM card in the Tele2 salon. For 20 days everything worked neither shaky nor rolls, and then the modem was completely bent. Brought it back to the salon. They took it for examination. The expert recognized the marriage of the modem. And the owner of the salon (IP) refused to return the money, motivated that the purchase was made more than 14 days ago. Through complex negotiations with the customer service, Tele2 managed to return the money.

Вот чисто по статье поняла, что один магазинов из нашего города не совсем чисто работает. В чеке там далеко не вся информация, а судя по объяснению “идеального” чека, так там даже более серьезные нарушения. Но магазин не сетевик, поэтому не знаю, чеки у них должны быть идентичны или нет. А в целом инфу из статьи запомню и рада, что перешла на электронные чеки)

Имеет гарантированный чек конечно очень важно имеет если вы делаете покупку на более солидную суму денег. Что бы имеет гарантию на возврат если вам что то не понравится в товаре который вы купили. И онлайн это конечно очень поможет в том что бы было меньше проблем.

На самом деле информация действительно полезная, но в случаях когда есть какая-то спорная ситуация. Сохранять все чеки нет смысла, не пойдете же вы возвращать чупа-чупс. По мне дак хранить надо чеки на дорогие покупки или с гарантией, в остальных случаях можно решить вопрос и без чека если своевременно обратится в магазин. Была ситуация, купили мы море продукты, а они тухлые, спустя час вернулись в магазин, продавец приоткрыв банку сразу спросил, обмен или возврат средств. Взяли другую банку, открыли при них понюхали и пошли домой с нормальной банкой. без чека все .

Вот раньше не задумывалась и не вникала, пока не столкнулась сама. Дали чек , ну и хорошо. Если покупка дорогостоящая, то хранила. Ну как то пришлось сделать возврат и …Чек оказался нелегальным. Для этого необходимо ввести данные кассового чека в специальные поля “ФН”, “ФД”, “ФП”, “Итог”, “Дата и Время”, “Вид чека” и отправить запрос на его проверку. Теперь проверяю каждый чек.

Да вот проверить на подлинность полученный после покупки товара чек, это бывает очень полезно и в этом помогаюет программы с помощью которых можно это сделать и ваши советы в это здорово помогают большое спасибо вам.